CGIAR Hub for Sustainable Finance (ImpactSF)

Science for Sustainable Food Investment

The CGIAR Hub for Sustainable Finance (ImpactSF) is a key technical partner for sustainable finance actors, integrating science-based impact KPIs in all areas of the investment lifecycle. This includes investment design, pipeline development, investment screening, due diligence, implementation, post-investment monitoring, reporting, and verification (MRV).

Building off CGIAR evidence, ImpactSF offers an array of data-driven solutions empowering financial institutions and investors to de-risk investments by quantifying climate and environmental risks and impacts. Our goal is clear: drive investments toward climate-smart and nature-positive Food, Land, and Water systems.

Products and services building on CGIAR Expertise

Market Intelligence

Research and synthesis of key market trends, innovations, and developments in the finance, climate, nature nexus of food system investments

Pipeline Development & Screening

Identification of potential new clients, screened for relevant financial, risk and impact KPIs

Technical Assistance

Advisory services to assist with improved agricultural practices & technologies, monitoring and reporting of KPIs, innovative climate financial mechanisms

Portfolio Risk & Impact Assessment

Data collection and analysis to provide insights into portfolio risk and current/potential impact KPI status

Taxonomy & Targets Alignment

Assistance with climate and nature related reporting requirements, validation of transition plan and article 9 qualification

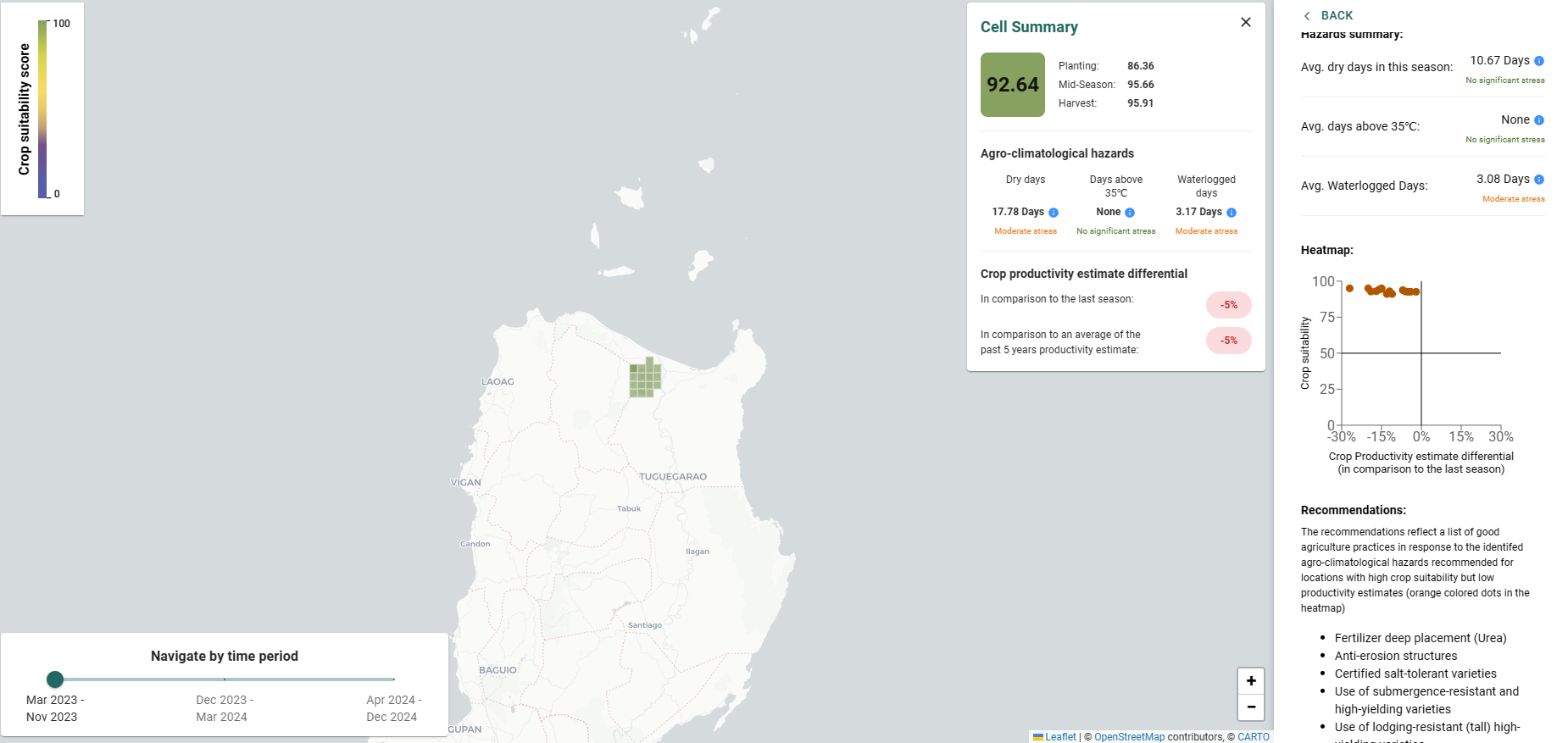

Our flagship product the ImpactSF Analyzer uses CGIAR science and data, along with the power of AI to assess agro-climatological and environmental risks to recommend relevant climate adaptation measures.

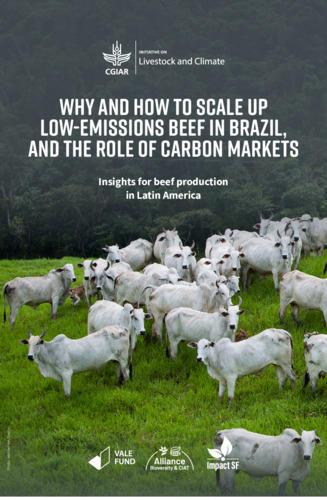

Food systems are grappling with a large financing shortfall to transition towards a net-zero, nature-positive, and inclusive economy. The existing financing architecture alone cannot bridge this gap without innovative and scalable financing solutions grounded in robust evidence. We will draw invaluable insights from ground-breaking funds co-designed by the CGIAR, responsAbility’s Climate Smart Food System Fund and Convergence’s sponsored Ag Waste Climate Fund and other examples. The event will explore strategies for expanding and replicating such pioneering mechanisms, including in fragile contexts.

Stakeholders

Global Investors & Assets Managers

Local & Regional Banks & Insurance

Corporates & Value Chain Actors

Publications

Countries

Accelerator/Pipeline building programs supported in 16 countries since Oct 2021, including the AICCRA Senegal Gender Smart Accelerator

Million

Climate Smart Food Systems Fund launched with responsAbility Investments AG. Impact SF provides end-to-end impact focused Technical Assistance

Banks & Regions

ImpactSF Analyzer being tested with 3 banks in 3 regions. This unique & innovative tool aims to automate climate and environmental risk assessment in credit scoring to facilitate agriculture finance

Would you like to partner with us?

Are you an investor or a banker?

Are you an Agribusiness Entrepreneur?

CGIAR Hub for Sustainable Finance (ImpactSF) is led by the Alliance of Bioversity International and CIAT

The Team

Godefroy Grosjean

CGIAR Sustainable Finance (ImpactSF) Co-Lead

Richard Newman

CGIAR Sustainable Finance (ImpactSF) Co-Lead

Burra Dharani Dhar

Scientist, Data Product Manager, CGIAR Hub for Sustainable Finance (ImpactSF)

Ena Derenoncourt

Gender-Smart Investment Specialist, CGIAR Hub for Sustainable Finance (ImpactSF)

Ciniro Costa Jr

Scientist

Wendy Francesconi

Senior Scientist, Theme Leader of Ecosystem Services and Environmental Impacts sub-lever

Peter Wamicwe

Investment professional

Luis Molina

Climate and Environmental Scientist

Samaa Mufti

Climate Smart Food Systems Specialist

Daniel Masika

Climate Resilient Food Systems Specialist

Natalia Matiz-Rubio

Industrial and Environmental Engineer

Lennart Hientz

Inclusive Finance Specialist

James Leyte

Senior Research Associate

Lorna Born

International Consultant

Jessica Koge

Program Research Associate

Donors