Blog De-risking Smallholder Farmers from Climate-induced Risks across Agricultural Commercialization Clusters

The Alliance of Bioversity International and CIAT, ATI, and Lersha are developing a climate-smart credit-scoring tool to improve smallholder farmers' access to credit. A workshop on July 15, 2024, in Addis Ababa highlighted its role in addressing climate risks and boosting productivity.

By: Sintayehu Alemayehu, Lidya Tesfaye, Yodit Yaregal Seyoum, Sintayehu Workneh, Tadesse Terefe, Melat Yemane

Edited by Joseline Kiogora

Climate-Credit Scoring Tool

Agriculture is essential for Ethiopia’s economy, contributing significantly to its GDP (32.6%). Smallholder farmers, who produce almost 95% of agricultural output, face significant challenges from climate change and variability such as irregular rainfall, temperature rises and pests. These issues reduce farm productivity, leading to food insecurity, income fluctuations, and slower economic growth. Enhancing resilience to climate change and variability risks is essential for improving productivity among smallholder farmers. However, their efforts are hampered by limited access to financial services, particularly credit and agricultural insurance. This restricts their ability to invest in climate-resilient and de-risking practices, leaving them vulnerable to climate risks.

To address these challenges, the Alliance of Bioversity International and CIAT, the Ethiopian Agricultural Transformation Institute (ATI) and Lersha are developing an innovative climate-smart credit-scoring tool. This tool aims to enhance smallholder farmers' access to credit and de-risk them through climate adaptation measures across Agricultural Commercialization Clusters (ACC) in Ethiopia. The innovative approach quantifies the risk reduction achieved through adaptation mechanisms, reflecting these efforts in farmers' credit ratings. This reduces risk in the financial and insurance sectors and encourages private investment through climate-smart credit scoring.

In alignment with these goals, a stakeholder consultation workshop was held on July 15, 2024, in Addis Ababa to advance the development of a climate-smart credit scoring tool. The workshop convened key stakeholders from the agricultural, financial, NGO, private, and research sectors to initiate the creation of this tool. The primary objectives were to foster collaboration, facilitate knowledge sharing, and ensure the tool's effectiveness and relevance within the Ethiopian context.

This initiative represents a significant stride toward empowering farmers and promoting sustainable agricultural practices amidst climate change challenges, while exploring the integration of adaptation strategies into farmer credit-scoring systems.

The development of this climate-smart credit-scoring tool is a crucial element of the Ukama Ustawi (UU) Initiative, which seeks to bolster resilience in agricultural ecosystems across East and Southern Africa. In Ethiopia, this initiative focuses on refining smallholder farmers' existing credit-scoring model by providing innovative opportunities for inclusive finance and insurance solutions. These are complemented by agro-climatic advisory services designed to enhance smallholder farmers' resilience and adaptive capacity. Furthermore, this tool supports the Agricultural Commercialization Cluster (ACC) initiative by integrating climate-resilient agricultural practices across the ACC woredas (districts). The tool addresses the critical challenge of financial access, promoting the adoption of essential agricultural inputs and implementing effective measures to mitigate climate change impacts.

“Even though we are not totally responsible for causing it, we are exposed to climate risks, and therefore we need to de-risk and commercialize agriculture to enable rural transformation that is centered around smallholder farmers and supported by insurance, finance and private investment.”

Climate-Credit Scoring Tool

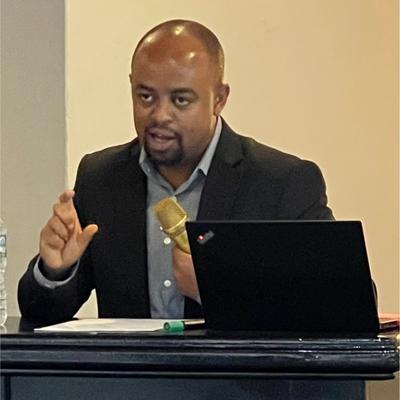

Dagnachew Lule giving the opening remarks at the workshop.

The workshop was opened by Dr. Dagnachew Lule, Senior Director of the Agricultural Commercialization Cluster Program from the Agricultural Transformation Institute (ATI), who stressed that “even though we are not totally responsible for causing it, we are exposed to climate risks, and therefore we need to de-risk and commercialize agriculture to enable rural transformation that is centered around smallholder farmers and supported by insurance, finance and private investment”.

Dr. Dagnachew emphasized a holistic approach to agricultural transformation. He advocated for a value chain perspective rather than focusing on isolated farm activities: “If we work along the value chain, we can bring change, we can also encourage people to see agriculture as a business. This involves collaboration, technology integration, and a shift in mindset from subsistence to commercial agriculture”. He added that digital tools, mechanization, and climate-resilient practices are crucial for this transformation, and that a robust private sector is essential for investment and innovation. He emphasized the importance of expanding the climate credit-score tool beyond maize to include other crops, which is vital for a diversified and sustainable agricultural economy. He appreciated the organizing institutions, noting that this is a timely initiative for transforming Ethiopia's agriculture sector.

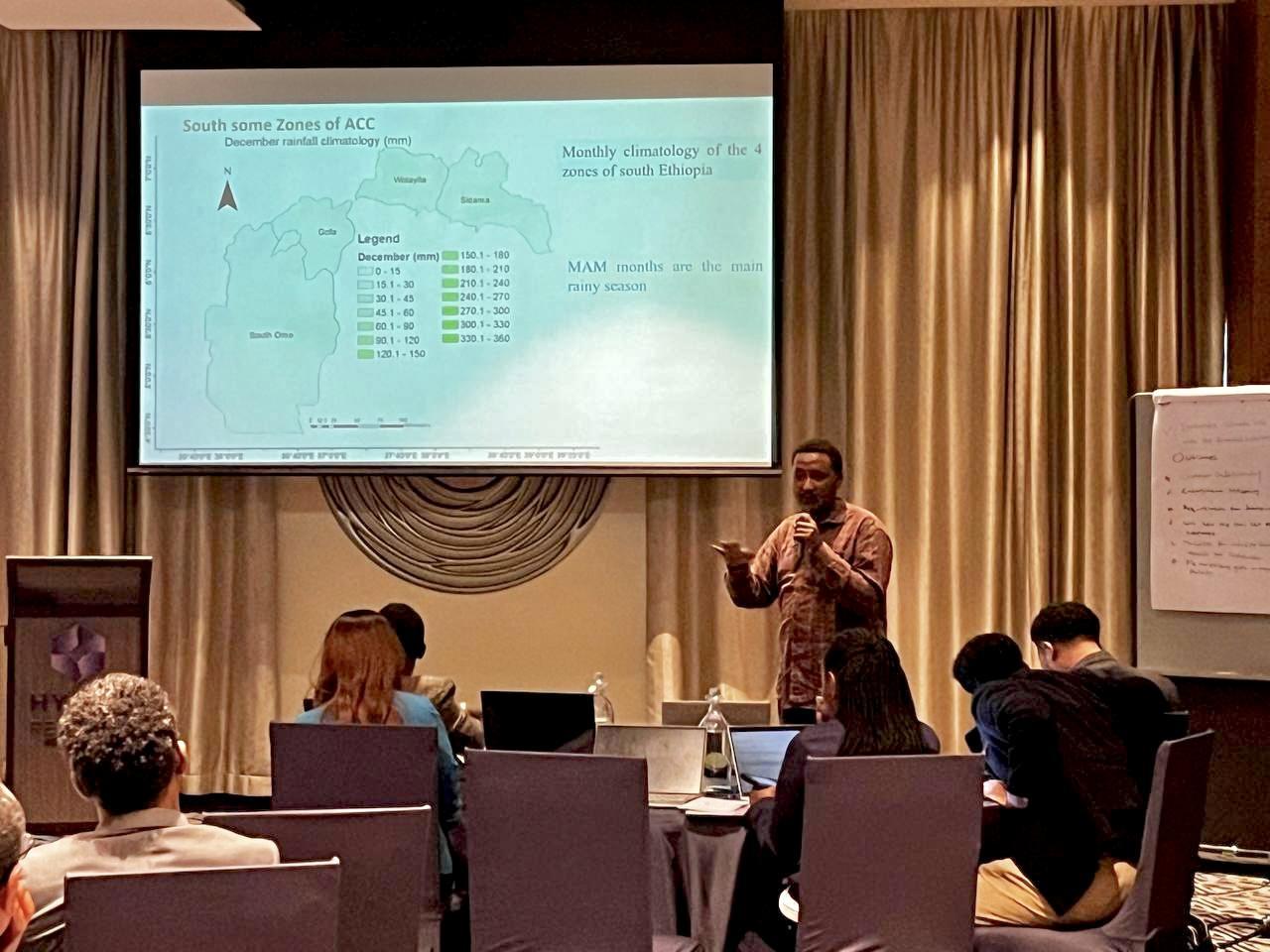

Alemaheyu Sintaheyu, Research Team leader discussing the results of ongoing research during the workshop.

Following the opening remarks, participants were introduced to the ongoing research aimed at integrating climate risk management across the ACC. Sintayehu Alemayehu - Scientist and Research Team Leader at the Alliance - introduced the climate risk profiling project being piloted in the maize value chain, one of the prioritized crops in the ACCs.

He emphasized the need to integrate climate forecasts and climate advisories in the ACCs to enhance agricultural productivity and resilience. As such, the team in collaboration with the EIAR has disseminated its third climate advisory.

Sintayehu Workneh, Research Management Coordinator leading the discussion on a study conducted in four zones of Ethiopia.

Dr. Sintayehu Workneh - Research Management Coordinator at the Alliance- and Dr. Tadesse Terefe - Research Coordinator at the Alliance - presented the findings of a study conducted across the four zones of Ethiopia. The study, which is part of the UU initiative, identified four key climate stressors of maize production including drought, heat, water logging and pests. The study also identified gaps in climate risk management across the ACCs. These include a lack of cluster-specific climate-smart agricultural practices and technologies, inadequate provision of climate information service, limited financial services, limited capacity, lack of context-specific agro-climatic advisory services and weak integration of climate risk management solutions in the existing digital services provided in the ACCs.

Climate-Credit Scoring Tool

Abrhame Endrias - Founder and Managing Director of Lersha - along with Shambachew Omer Hussen, highlighted the need for a climate-smart credit-scoring tool to improve the existing credit-scoring model used by financial institutions. Their presentation emphasized how this tool could more accurately assess farmers' creditworthiness, providing lenders with a deeper understanding of the associated risks. This, in turn, would help bridge the financing gap and transform Ethiopia's agricultural sector.

Following the series of presentations, participants delved into plenary discussions where key themes emerged regarding the climate-centric scoring tool. These included identifying the tool’s targeted beneficiaries, such as smallholder farmers, commercial farmers, or private investors; enhancing gender responsiveness and youth inclusion; and engaging with the private sector to address challenges in agricultural investments. Other important topics included evaluating and bundling various insurance mechanisms, reducing high interest rates and collateral requirements for agricultural credits, and timing the provision of critical farming inputs and financing. Additionally, discussions covered assessing the agricultural knowledge and information gaps of financial practitioners, understanding the impact of farmers' behavioral and psychological factors on credit risks, and the need for awareness and capacity building for both farmers and financial actors.

Taddese Terefe leading the discussion on a study conducted in four zones of Ethiopia.

Participants in plenary discussion.

Ways Forward

The workshop concluded with recommendations for the next steps in the development of the climate-centric credit-scoring tool:

- A separate vulnerability assessment of smallholder farmers is essential to develop a tailored credit product that considers the exposure, capacity and resources of different farmers

- De-risking agricultural finance by providing adequate information and bundling with insurance, technical advisory and inputs

- Creating an enabling policy landscape to improve regulatory bottlenecks

- A farmer-centered credit vetting and appraisal approach

- Credit services beyond the production stage and into the value chain

- Gender-responsive credit scoring model

- Specific and contextualized credit schemes based on different criteria

- Financial capacity building and awareness creation for farmers

- Capacity building on agricultural practices for financial institution practitioners

- Developing bankable agriculture development plans

- Linkage with micro-finance institutions (MFI) and insurance providers

- Mapping and linkage with the private sector to assess challenges and gaps

The participants agreed on the importance of ongoing engagement in developing the climate-centric credit-scoring tool. This tool aims to address the current agricultural financing gap by mitigating climate-induced risks for smallholder farmers in Ethiopia, ultimately transforming the country's agriculture sector.

The Team

Sintayehu Alemayehu

Project Leader

Sintayehu Workeneh Dejene

Research Management Coordinator

Lidya Tesfaye

Research Officer