Press and News How a Climate-Credit Scoring tool is revolutionizing Agricultural Finance in Africa

The Alliance of Bioversity International and CIAT, with partners like FACS and ECLOF, introduces a groundbreaking climate-credit scoring tool. Developed under the Livestock and Climate Initiative, it integrates climate data to assess and address financial challenges for over 33 million smallholder farmers in Africa, particularly in Kenya's dairy industry facing US$800 million annual weather risks. This innovative tool overcomes traditional lending limitations, offering a comprehensive risk score, aiming to transform the financial landscape for vital smallholder farmers.

By: Shalika Vyas, Joseline Kiogora, Pedro Chilambe, Aniruddha Ghosh, Evan Girvetz, Julian Ramirez-Villegas

In Africa, over 33 million smallholder farms are the backbone of the continent’s food supply, yet their access to financial services is woefully limited. Traditional lending models often overlook these farmers due to perceived high risks and operational costs. Add to this the increasing vulnerability to climate extremes, and the scenario becomes even grimmer. In Kenya, for instance, the dairy industry faces over US$800 million in annual risks from weather hazards, making financial institutions even more hesitant to lend.

Enter the climate-credit scoring tool, a novel approach integrating a climate module into traditional credit assessments. This tool, developed by a collaboration between The Alliance of Bioversity International and CIAT through the Livestock and Climate Initiative, Financial Access Consulting Services (FACS), and lending institutions like ECLOF, is a game-changer. It uses state-of-the-art climate data and over 30 indicators developed by dairy experts to provide a comprehensive risk score for each farmer.

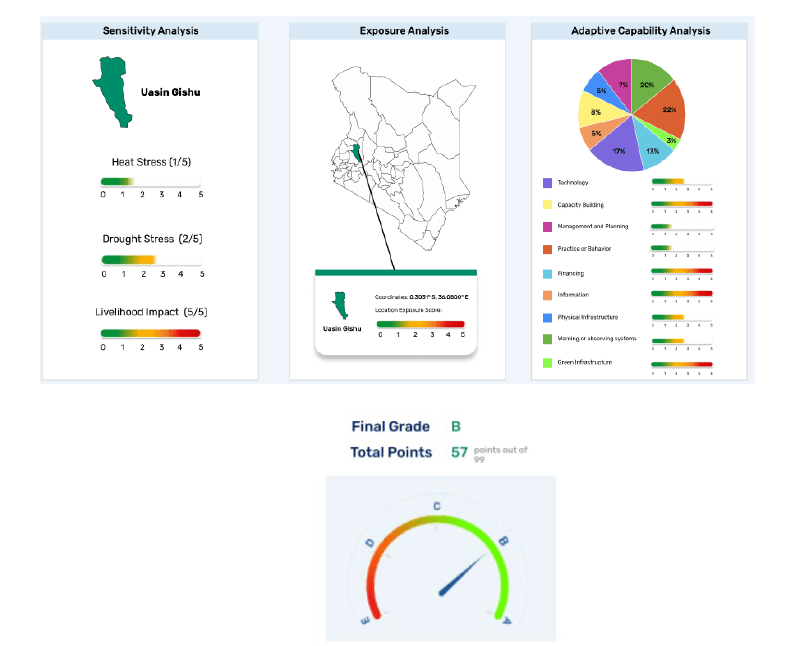

What sets this tool apart is its holistic approach. The climate component of the tool is based on IPCC's framework based on sensitivity, adaptive capacity, and exposure dimensions. It considers multiple attributes like from farm quality, financial position, and personal data to detailed climate risk profiling. This not only allows farmers to demonstrate their creditworthiness in new dimensions but also empowers lenders with a nuanced understanding of the risks involved. The result? Fairer, more precise lending decisions that encourage financial inclusion and empower farmers to adapt to climate change.

The tool goes beyond mere numbers, illustrating farmer locations and specific climate risks they face in easy-to-understand graphics. This visualization aids both farmers and financial institutions in understanding the nuances of climate resilience and adaptation pathways.

Screenshot of the climate module of the risk scoring tool, showing scores for each category of the climate analysis.

The current pilot with 500 farmers in Kenya is just the beginning. The plan is to roll this tool out more broadly, integrating it into existing lending platforms and training financial professionals to harness its full potential. This endeavour is not just about mitigating risks for lenders; but also paving the way for a future where smallholder farmers are no longer marginalized by the financial sector but are active participants in a climate-resilient agricultural economy.

The climate-credit scoring tool promises a future where financial inclusion and climate resilience go hand in hand, ensuring that both lenders and farmers thrive even in the face of climate uncertainties. This is not just finance; it’s finance with a vision, a sustainable and inclusive future for all.

The Team

Evan Girvetz

Principal Scientist and Team Leader

Julian Ramirez-Villegas

Director (a.i.), Climate Action, and Principal Scientist on Climate Impacts