From the Field Bridging the Gap: How CGIAR's ImpactSF Analyzer Empowers Banks to Finance a Sustainable Future for Agriculture

Access to finance has long been a challenge for the agriculture and food sectors, despite being the backbone of food security for millions of people across the world. Small-scale farmers and small and medium-sized enterprises (SMEs) in developing countries often need help to secure loans due to perceived high risks and low profitability, despite their significant contribution to global food production.

To respond to this challenge, the CGIAR Hub for Sustainable Finance (ImpactSF) has developed a unique AI-powered solution, the ImpactSF Analyzer, which is currently being piloted by multiple banks in Southeast Asia and Africa.

The ImpactSF Analyzer leverages science and data from the CGIAR and predictive AI to deliver location-specific insights and risk assessments, empowering financial institutions to:

- Quantify potential environmental and social impacts of their investments: This enables banks to align their lending portfolios with sustainability goals and promote responsible investing.

- Improve financial returns: Precise risk assessments and granular insights lead to better-informed investment decisions, potentially boosting revenue from agricultural lending.

- Provide advisory services to beneficiaries: By understanding the multifaceted challenges faced by smallholder farmers, banks can offer targeted support and guidance, fostering resilience and productivity.

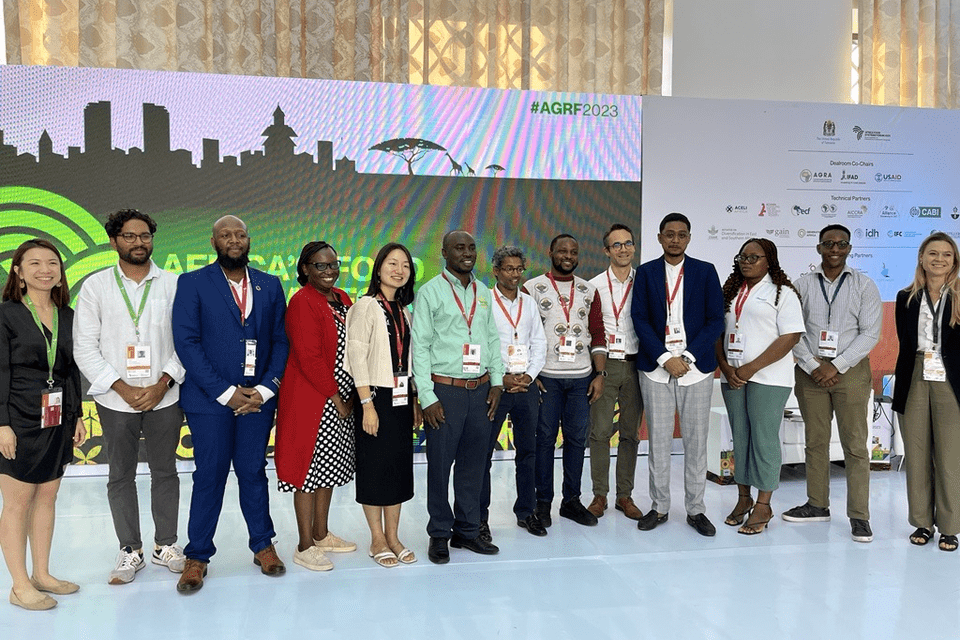

On the 26th of January, the CGIAR Hub for Sustainable Finance (ImpactSF) and the Asia-Pacific Rural and Agriculture Credit Association (APRACA) organized a one-day workshop in Bangkok, Thailand, to sensitize the banking sector and financial institutions from the ASEAN region on the potential of ImpactSF Analyzer's to de-risk their lending portfolios in agriculture while simultaneously generating and reporting environmental and social (E&S) impacts from their investments in agricultural value chains.

This workshop brought together top management from ASEAN banks to share experiences and best practices in sustainable agriculture lending and provide valuable feedback on the ImpactSF Analyzer's user experience and data needs.

According to ImpactSF’s Co-Lead, Dr. Godefroy Grosjean, this collaborative approach underscores the commitment of both CGIAR and regional partners to bridging the gap between financial institutions and the agricultural sector.

"We are facilitating the groundwork for a win-win situation for financial institutions to grow their investment in a previously shunned market while at the same time helping financing reach small businesses and individuals that need it the most to improve resilience and productivity." Says Dr. Godefroy Grosjean

The workshop showcased the importance of collaboration in unlocking sustainable finance in Southeast Asia. Attendees included top management from risk management, strategic development, and credit departments of various ASEAN banks, fostering a valuable exchange of experiences and insights.

Dr Prasun Kumar Das from APRACA, echoed this sentiment, stating, "This workshop is part of our work to ferment strategic partnerships with scientific institutions such as CGIAR to help banks effectively assess operational risk, provide beneficiaries with advisory services, and catalyze new investments by financial institutions in the Asia Pacific."

The ASEAN-CGIAR Regional Program is contributing to sustainable development in Southeast Asia, and the ImpactSF Analyzer's comprehensive risk and value assessment tool for environmental and social impact is a prime example. This demonstrates the effectiveness of understanding the complex realities of agricultural lending and fostering responsible financing practices with contextualized tools and innovation.

The workshop also enjoyed the support of key organizations like the Australian Centre for International Agriculture Research, the Foreign Commonwealth and Development Office of the UK, and the ASEAN secretariat. This collective effort highlights the commitment to co-designing data-driven solutions that address the specific needs of the region's banking sector within the context of sustainable agricultural lending.

The CGIAR Hub for Sustainable Finance (ImpactSF) is a key technical partner for sustainable finance actors, integrating science-based impact KPIs in all areas of the investment lifecycle. This includes investment design, pipeline development, investment screening, due diligence, implementation, post-investment monitoring, reporting, and verification (MRV).

For more information on the ImpactSF Analyzer

The Team

Godefroy Grosjean

CGIAR Sustainable Finance (ImpactSF) Co-Lead

Richard Newman

CGIAR Sustainable Finance (ImpactSF) Co-Lead